The day ahead

Weather – Hotter and dryer in Argy. The Euro model, which has been the one building as much as 100mm in the 15-day outlook reduced its number by around 10-20mm overnight and added another 2-3 degrees which will see max temps over 40°C in some areas.

Markets – Commodity markets were generally higher overnight – interestingly including energy. I was expecting a lower print in crude given the Israel/Hamas cease fire however, US inventories fell for the eighth straight week.

Australian day ahead – AUD finally above 0.6200 but not really with any conviction. This is not an opinion piece but I can make an argument for a higher AUD over the next few weeks. USD risk premium gets reduced with the ceasefire and some of the Trump fear bleeds out – but markets will be volatile for sure.

Offshore

CPI – From a high level, US inflation is slowing again. Markets reacted with a higher equities market, posting the biggest gain since Donald got the nod. Treasuries rallied, 10yrs in particular with yields falling by 15 basis points.

Canada revealed its “you started it” retaliation if and when the US imposes Donald’s 25pc tariff. The list amounted to C$150 billion in US-manufactured items that it would smack with tariffs but stressed it would only do so if the US were to make good on its threat.

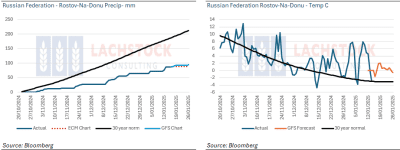

Russian city Rostov-on-Don has experienced anomalies of high temperature and low rainfall in recent months. Click to expand. Source: Bloomberg via Lachstock Consulting

The Russian wheat tap has well and truly been turned off. January is set to be the lowest export month since 2017. While the season still has a long way to go, Russian temps are running well ahead of normal. Ordinarily, Rostov would be sub-freezing now but have averaged 3°C since the beginning of the year.

Canada approved the acquisition of Viterra by Bunge. As I understand it, China is still not approved.

FranceAgriMer forecast French 2024/25 soft wheat exports down 40 percent y-o-y, at 9.74 million tonnes (Mt), versus its December estimate of 9.76Mt. It cut its barley export forecast thereby increasing barley carryout to 1.61Mt from December estimate of 1.38Mt.

The Rosario Board of Trade cut Argentine soybean production to 53Mt from 53.5Mt, and corn to 48Mt from 50Mt (USDA 51Mt).

Australia

WA canola bids were slightly down, to $875 FIS. WA wheat was firmer, bid $380, with barley around $328, showing a few dollars’ variance by PZs.

Canola bids in the east were off by around $3, to around $819. Wheat was largely unchanged around $345, and barley $304.

Delivered wheat markets were well bid yesterday, with buying competition predominantly for ASW. Up-country homes were trading at approximately $365 delivered Melbourne equivalent, in contrast to the track market, which remains lacklustre.

There is still good packer demand for GM canola into Melbourne/Geelong, with bids around $710.