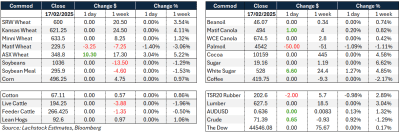

US exchanges were shut overnight for Presidents’ Day Holiday. Matif wheat eased 1pc and Australia eastern wheat ASX gained 3pc.

Weather: SAM weather continues to improve with more good rainfall forecast over the next 14 days, adding yield to soybeans and later planted corn. Russian weather still a massive watch globally with cold temps and little rainfall forecast over the next 14 days.

Markets: US markets closed overnight. Global canola markets were unchanged to slightly higher.

Australian Day ahead: With the Presidents Day holiday for the US overnight no real direct on whether wheat futures continue their trajectory. Expect cereal bids to be slightly firmer again buoyed by global weather concerns and strong domestic feed bids. RBA rate decision expect a cut of 25bp which might stop any positive moves for the Aussie dollar.

Offshore

At average price US$276.37/t CandF Saudi Arabia bought 920kt milling wheat in an optional origin tender originally calling for 600kt. Origin options were EU, Black Sea, North and South America and Australia.

StatsCan reported December 31 canola stocks at 11.4 million tonnes (Mt), down 19 percent on last year. December canola usage was 9.3Mt, the highest since 2020/21.

CFTC data showed spec funds trimmed their net long in CBOT corn by ~30k contracts to 332k long this week, prior to that they had been net corn buyers for seven consecutive weeks. Funds reduced their spec net short in CBOT wheat for the second consecutive week.

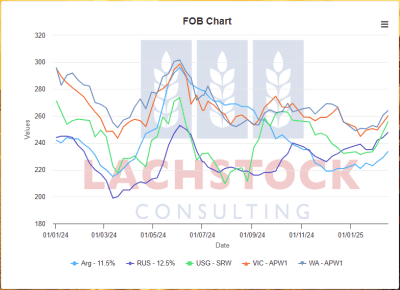

Russian wheat price continued to rise. It is quoted around $250/t, 12.5% pro, up from $235/t a month ago. The export restrictions for Russian wheat export restrictions commenced February 15, from which date wheat export total was capped at 10.6Mt until end June.

Wheat price US$/t free on board January 2024 to present. Russian (dark blue line) 12.5 pro has firmed more than 5 percent in the past month. Source: Lachstock. Click expand.

Australia

WA canola bids started the week bid around $855. Wheat bids worked higher, on the back of Friday night higher futures, to around $376 and barley was bid $345.

Eastern Australian beginning week bids were supported. Canola was bid $775, wheat $353 and barley $318.

Canola meal is currently pricing around $480 FOT ex crush plants, which is around 70pc of soybean meal price. Domestic feed mills and stock feeders are using it in place of lupins which are few and far between.

South Australian end users are now having to price into SNSW and Victoria to attract the wheat and barley tonnages required to extend coverage deeper into the year.

RBA cash rate decision today with most analysts calling for a cut of 25bp.