The day ahead

Weather – Parts of the Texas Panhandle are on flood watch today post receiving another 2-3 inches overnight. The forecast will offer some reliefwith a dry 7-day window for the worst hit areas. The pattern will move north catching northern KS into NE. Winter is coming. A chunk of Saskatchewan is set to receive 10-20 inches of snow in the coming 7 days. More of the same for the Black sea with the Southern region missing again.

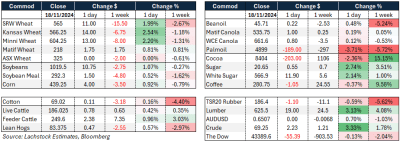

Markets – Turn around Monday. Green across the board with the exception of palmoil which was meaningfully lower after the China announcement. AUD still hovering around the 0.6500 mark. Technical resistance in corn should hold given Brazil agreement with China.

Australian day ahead – Firm. Some support from offshore futures markets overnight which maybe a little overdone after the USDA crop condition rating came out a little better than expected. US wires talking about the rainfall forecast in WA. Canola may take a breath, wheat and barley should continue to find support.

Offshore

China has removed export tax rebates for several metals, used cooking oil, some refined oils and solar and battery products.

China shipped 2.12Mt of UCO in the first nine months of this year, more than the total volume exported in the whole of 2023. Palmoil felt the brunt of this move, both in Malaysia and in DCE futures.

President Joe Biden has, for the first time, authorized Ukraine to use US-provided long-range missiles to target locations within Russia, a move that allies of President-elect Donald Trump warn could escalate tensions and risk triggering “World War III.”

Russia responded by launching one of its largest missile and drone strike s against energy infrastructure and other targets across the Ukraine.

China and Brazil continue to strengthen their trading relationship with President Xi visiting. They inked a trade deal that includes Ag products. The details of which will be released on Wednesday, but most expect a large purchase of corn to be included.

According to Cereals Canada, the 2024 Canadian wheat crop will reach 34.3Mt, 8 percent higher than the 5-yr average. Exports are predicted 25.4Mt this year which would make Canada the world’s 3rd largest wheat exporter, knocking Australia down to 4th.

Australia

In the west, canola values were up to begin the week, being bid $872 with GM $767. Wheat and barley began the week unchanged, bid $375 and $325 respectively FIS. In the east of Australia, canola started the week with bids up a few dollars, bid $811 and GM $745. Cereal values were unchanged to begin the week.

Faba bean bids continue to be strong, being bid $648 delivered Geelong/Melbourne for Jan+. In SA, beans are bid $675 PAD, with exporters struggling to secure any significant quantities this year.

Delivered Darling Downs markets have found a level of support at around $320 delivered after gaining around $15 over the last month. Wheat is bid around $340 for Jan+.

Harvest will be on in earnest over the next 4–5 days as growers aim to get as much off as possible before rain arrives through SA, Vic, and SNSW, where 25mm is forecast for most parts.

It has been a decent start to the NSW canola export program, with 180kt on the stem for November and at least 1 x 60kt expected to be shipped in December. Our LSC full-year canola export forecast is only a modest ~500kt ex-NSW. WA is also off to a decent start on exports, with 360kt on the stem for November.