The day ahead

Weather – Over the past 30 days most row cropping regions in Argentina have received less than 50 percent of their normal rainfall, and the region suffering the most is the Buenos Aires province where large parts have received sub 25pc of normal rainfall.

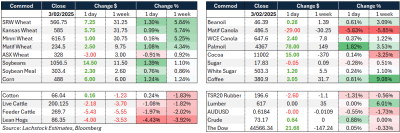

Markets – Global ag markets were stronger across the board overnight reacting to shifts in tariff news, wheat particularly with less-than-optimal conditions through Russian growing regions now also having an influence.

Australian day ahead – Expect wheat bids to work higher supported by global futures. Feed grains feel like they have been catching a bid in recent weeks expecting this to continue to encourage the slow pace of grower selling as end users look to extend cover.

Offshore

Mexico was granted a month-long reprieve on tariffs which provided some support for corn markets overnight. Canola markets garnered some optimism as Prime Minister Trudeau and President Trump continued dialogue around tariffs.

The US exported 1.25 million tonnes (Mt) corn in the past week, with Mexico the largest destination, and 252kt wheat, which brought the year-to-date total to 14Mt, 21 percent ahead of last year’s pace.

The CFTC data showed that spec funds added again this week to their net long in CBOT corn, adding 39k contracts to put them at 350k long which is the largest since May 2022.

Brazil has harvested just shy of 10pc of its 24/25 soybean crop, according to StoneX. This compares to 3.5pc last week and 14.9pc last year.

Russia’s wheat exports in February estimated at 2.2Mt to 2.3Mt over 50pc down over the same period last year, according to analytical centre of railway operator Rusagrotrans. It would also be the lowest level of exports since February 2020.

Australia

Western Australian canola and wheat were unchanged to begin the week. The bids were around $835 and $374 respectively, as exporters digested tariff news. Barley saw some further uplift with bids around $345.

Eastern Australian canola bids eased around $3-$5 to be bid $757. Wheat was off slightly, bid around $343 and barley gained to around $315 bid.

Barley has been working higher over the last week or two, particularly through WA, but in the last couple of days the east has made up some ground. Mexico is a factor supportive of Australian barley. It has a significant feed grains hole and has large US corn purchases on the books which will be influenced by tariffs.

The low Aussie dollar has been supporting pulse bids. Chickpeas were $900 delivered Brisbane, lentils around $930 delivered Melbourne, and faba beans $670 delivered Geelong/Melbourne for April+ delivery.