Cotton T-shirts, singlets, and vests (HS- 610910) are a staple in the global apparel trade due to their versatility, affordability, and widespread demand across different markets. These garments, offering comfort and style, remain in high demand throughout the year, particularly in the US, where they are a go-to choice for casual wear. Given the competitive landscape, countries like Nicaragua, Bangladesh, and Honduras have a significant role in shaping US imports of these products.

Cotton T-shirts are one of the few categories where China does not feature in the top 5 exporting countries. This could be due to China’s concentrated efforts on other apparel as well as the product’s popularity among Latin American trade partners of the US. Fibre2Fashion explores the impact of tariff hikes and shifting trade dynamics among competing countries in the US market.

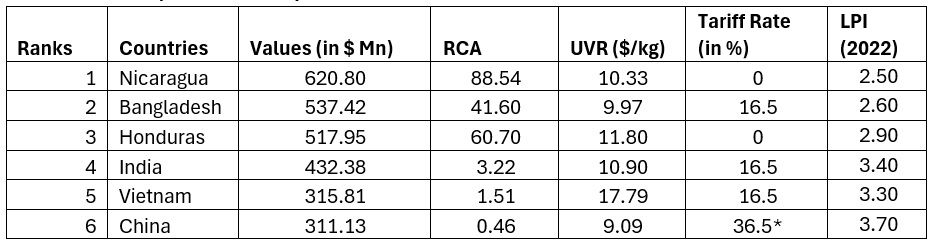

Table 1: Key Exporting Countries to the US and Trade Statistics—Cotton T-Shirts, Singlets, and Vests in CY 2024

Note: RCA - Revealed Comparative Advantage; UVR - Unit Value Realisation; LPI - Logistic Performance Index

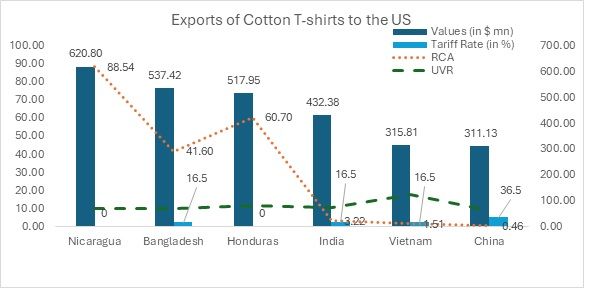

Figure 1: Key Exporting Countries to the US and Trade Statistics- Cotton T-Shirts, Singlets, and Vests in CY 2024

Nicaragua - Dominant exporter with strong RCA

Nicaragua leads the cotton T-shirt, singlet, and vest exports to the US, with a significant export value of $620.80 million. With an RCA of 88.54, Nicaragua holds a commanding position, indicating its high competitiveness in this category. It may be noted here that a free trade agreement between the United States and the Dominican Republic and other Central American countries—called the Central America-Dominican Republic-United States Free Trade Agreement (CAFTA-DR)—was signed on August 5, 2004.

However, Nicaragua’s UVR of $ 10.33/kg places it in the middle of the price range, meaning it caters to a broad range of consumers while maintaining a strong presence in the market.

Bangladesh - Strong competitor with high RCA

Bangladesh ranks second in the US cotton T-shirt exports, with total shipments valued at $537.42 million and an impressive RCA of 41.60, highlighting its strong competitiveness in the sector. With a UVR of $9.97/kg, Bangladesh remains one of the most cost-effective suppliers, offering high-quality products at competitive prices. However, a 16.5 per cent tariff on exports to the US poses a challenge to its cost advantage, yet the country continues to maintain a strong position in the global market.

Honduras - Consistent growth and competitive RCA

Honduras ranks third in cotton T-shirt exports to the US, with shipments valued at $517.95 million and a remarkable RCA of 60.70, underscoring its strong trade competitiveness in this segment. With a UVR of $11.80/kg, Honduras operates in a slightly higher price range, catering to a more premium market segment. The country enjoys tariff-free access to the US market, providing a significant competitive advantage over exporters facing higher tariff barriers.

India - Growing competitor in a competitive market

India ranks fourth in cotton T-shirt exports to the US, with shipments valued at $432.38 million. While its RCA of 3.22 indicates moderate competitiveness, its UVR of $10.90/kg positions it as a key player in the US market. The country faces a 16.5 per cent tariff on exports, which may impact its cost-effectiveness. However, India benefits from a strong domestic supply of raw cotton, ensuring stable input availability and supporting its export potential.

Vietnam - Consistent exporter but faces challenges

Vietnam ranks fifth in cotton T-shirt exports to the US, with shipments valued at $315.81 million. Its RCA of 1.51 indicates lower competitiveness compared to other leading exporters, while its higher UVR of $17.79/kg positions it in the premium market segment. Although the elevated UVR may limit price competitiveness, Vietnam continues to attract high-end buyers. Like Bangladesh and India, Vietnam also faces a 16.5 per cent tariff on exports to the US, which could impact its overall market positioning.

China - Declining competitiveness with lower RCA

China ranks sixth in cotton t-shirt exports to the US, with shipments totalling $311.13 million. Its RCA of 0.46 reflects a weak competitive position in this segment. With a UVR of $9.09/kg, China operates in a lower price range, competing with cost-effective suppliers like Bangladesh and India. However, the 16.5 per cent tariff on exports to the US further erodes its price competitiveness, posing challenges for maintaining market share. Additional trade barriers could further weaken China’s position, creating opportunities for other exporters to capture its market share.

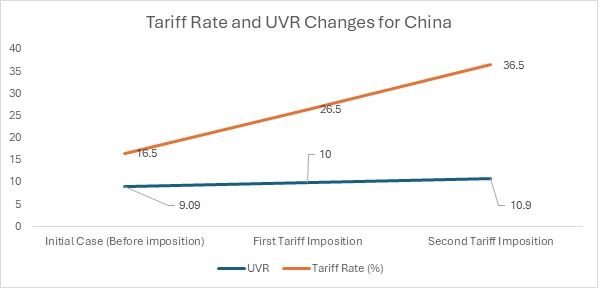

With the first tariff imposition on February 4th, 2025, China’s tariff rate increased to 26.5 per cent. This increase in the tariff burden would cause the UVR to rise as production and export costs escalate. As a result, China’s UVR would likely increase to around $10/kg, reflecting the growing challenges posed by the higher tariffs. The increase in the UVR indicates that China’s traditional low-cost advantage is being eroded, making its cotton T-shirts less attractive to price-sensitive consumers.

Source: F2F Analysis

In the second tariff imposition, effective from March 4th, 2025, China’s tariff rate rose even further to 36.5 per cent. This significant rise would push China’s UVR closer to $10.9/kg or higher. The higher tariff burden will severely limit China’s ability to offer affordable products, pushing its cotton T-shirts further into the mid-priced segment. This also means that China would have Bangladesh as its competitor, which would now offer cheaper cotton T-shirt options to the US.

Competitive landscape and future outlook

The data for cotton T-shirts exports to the US from 2020 to 2024 highlights key trends. Nicaragua leads with strong growth, rising from $421 million to $620 million, solidifying its dominance in the category with a high RCA. Bangladesh follows, expanding from $242 million to $537 million, supported by a low UVR but challenged by tariffs.

Honduras, despite a slight dip in 2024 after peaking in 2022, remains competitive due to its tariff-free access. India shows steady growth from $207 million to $432 million, benefiting from intermediate product use but facing moderate RCA and tariff challenges. Vietnam sees modest growth from $268 million to $315 million but struggles with a higher UVR, while China, though still a major exporter, faces declining competitiveness due to tariffs.

Nicaragua remains the clear leader, while Bangladesh and Honduras maintain strong positions. India continues to expand, while Vietnam and China face increasing challenges in the US market.