The Indian government recently announced a massive auction to buy 200,000 tonnes more green hydrogen-based ammonia than it originally planned on behalf of the fertiliser sector.

The decision, announced on Saturday, 22 June 2024, two weeks after the tender's launch, is a result of higher-than-expected demand for the product.

It had earlier launched a tender for ten-year contracts in which it planned to purchase 539,000 tonnes a year of green hydrogen-derived ammonia, to be split across eleven projects with delivery points across the country.

This is a significant step towards demand creation of green hydrogen and its derivatives in the country.

The Indian government had launched the National Green Hydrogen Mission on 4 January 2023 with an outlay of Rs 197 bn up to FY30.

The goal was to become Aatmanirbhar (self-reliant) through clean energy and serve as an inspiration for the global clean energy transition.

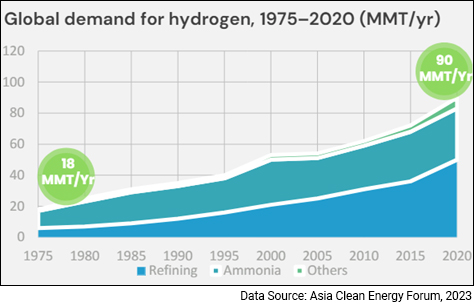

The initial demand growth for this green fuel is expected to stem from mature markets such as refineries, ammonia, and methanol, which are already using hydrogen as an industrial feedstock and in chemical processes.

In the longer term, steel and heavy-duty trucking are likely to drive most of the demand growth, accounting for almost 52% of total demand by 2050.

So, which listed companies are leading the way when it comes to green hydrogen?

Here's the entire list of green hydrogen stocks, covering the entire value chain of this futuristic fuel.

#1 Reliance Industries

First on the list is Reliance Industries.

Reliance Industries is the largest Indian private-sector corporation. It has evolved from being a textiles and polyester company to an integrated player across energy, materials, retail, telecom, entertainment, and digital services.

Reliance Industries is one of India's largest manufacturers of green hydrogen.

The company's green hydrogen is used for domestic consumption and global sales, contributing significantly to reducing carbon emissions.

Moreover, this company uses both green hydrogen and CO2 as raw materials to create a plan for developing new green chemicals, fertilisers, and e-fuels.

In line with its focus on green hydrogen, Reliance Industries signed an agreement in May 2024 with Norway's Nel ASA for sourcing technology to make electrolysers for green hydrogen production.

The agreement provides Mukesh Ambani's Reliance with an exclusive license for Nel's alkaline electrolysers in India and also allows the company to manufacture Nel's alkaline electrolysers for captive purposes globally.

Further, Reliance is building a Dhirubhai Ambani Green Energy Giga Complex over 5,000 acres in Jamnagar, Gujarat, India. Part of the complex are different giga factories, including an electrolyser manufacturing factory, for the production of green hydrogen.

The company had earlier said it is collaborating with Denmark's Stiesdal A/S for their HydroGen electrolysers manufacturing in India.

Reliance was also allotted 300 megawatts (MW) of capacity in 2024 under the government's production-linked incentive scheme (PLI) for electrolyser manufacturing.

Going forward, it plans to transition to green hydrogen production by 2025 and become net zero by 2035.

The company plans to invest Rs 750 billion (bn) over three years to set up its clean energy business.

It also plans to invest Rs 5 trillion (tn) in the next 10-15 years to set up a 100 GW renewable-energy power plant and green-hydrogen ecosystem development.

For more details, see the Reliance Industries company fact sheet and quarterly results.

India's Third Giant Leap

Our research suggests this leap could potentially generate wealth at a scale we've probably never seen before.

We are going to share our entire research... including the best category of stocks to ride this mega opportunity at our upcoming event.

Click Here to See Full Details

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------------

#2 Adani Green Energy

Next on the list is Adani Green Energy.

The company is involved in renewable energy generation and ancillary activities.

Adani Green Energy develops, builds, owns, and operates solar and wind power projects, solar parks, hybrid power generation projects, etc.

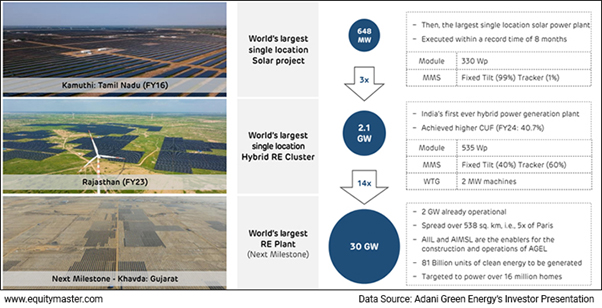

Currently, Adani Green Energy is developing a 30 GW renewable energy plant on barren land at Khavda in Kutch of Gujarat over an area of 538 sq. km, after which it would become the planet's largest power plant regardless of the energy source.

The area of the project in Khavda is five times the size of Paris and almost as large as Mumbai.

It's a hybrid renewable energy cluster where during the morning hours, solar energy is generated and during the evening hours, wind generation is generated. It has an operationalised capacity of 2,000 MW solar energy.

Currently, the company largely exports from its existing solar module manufacturing capacity of 4 GW. Its solar modules and wind turbine manufacturing capacities are located at Mundra in Gujarat.

The company has long-term expertise in developing mega-scale renewable energy projects.

In FY25, the company plans to add 1 GW of wind turbine capacity, taking the overall wind turbine manufacturing capacity to 2.5 GW, and another 2.5 GW may be added by the end of the financial year 2027.

With this project, India is poised to avoid about 58 million tonnes of CO2 emissions annually.

Going forward, the company plans to invest about Rs 1.5 trillion (tn) by 2030.

For more details, see the Adani Green Energy company fact sheet and quarterly results.

#3 Adani Total Gas

Next on the list is Adani Total Gas.

The company is a joint venture between Adani Group and Total Energies.

While Adani Green Energy focuses on large-scale green hydrogen production, its sister company, Adani Total Gas (ATGL), is taking a different but equally crucial approach in the green hydrogen space: blending.

Adani Total is pioneering green hydrogen blending projects in India.

Their focus lies on seamlessly integrating green hydrogen with existing natural gas infrastructure.

For the same, the company in November 2023 launched a groundbreaking green hydrogen blending pilot project in Ahmedabad. This project aims to blend green hydrogen with natural gas supplied to over 4,000 residential and commercial customers.

Green hydrogen is produced using electrolysis of water with electricity generated by renewable energy. Hydrogen blending is less carbon-intensive than burning gas but has the same heating capabilities.

The project is expected to be commissioned by FY25, and the percentage of green hydrogen will be gradually increased in the blend to up to 8% or more, depending on regulatory approvals.

The Ahmedabad pilot project serves as a crucial first step. Upon successful completion, Adani Total Gas plans to gradually expand the supply of hydrogen-blended fuel to larger parts of the city and other areas under their license.

The company is actively seeking collaboration with various stakeholders, including regulatory bodies. This collaborative approach aims to share learnings from the pilot project and contribute to developing a robust green hydrogen blending ecosystem in India.

Going forward, Adani Total Gas plans to maintain a leadership position in green hydrogen blending.

For more details, see the Adani Total Gas company fact sheet and quarterly results.

#4 L&T

Next on the list is L&T.

Semiconductors, 5G telecom, renewable energy, SpaceTech, metro rail, and defence.

How many Indian companies have won orders in each of these segments recently? The only company is L&T.

The company is the most respected multinational conglomerate that operates in over 50 countries with unmatched capabilities in all its businesses, including construction, engineering, technology, and manufacturing.

The company, in March 2024, commissioned its first indigenously manufactured hydrogen electrolyser at the green hydrogen plant in Hazira, Gujarat.

This signifies L&T foray into domestic electrolyser manufacturing.

It is equipped with two stacks and an electrolyser processing unit ML-400 and offers exceptional flexibility and thermal stability.

Additionally, L&T's newly established entity, L&T Electrolysers, focuses on manufacturing pressurised alkaline electrolysers using technology from McPhy Energy in France.

The company plans to utilise its upcoming giga-scale Hazira facility to meet the increasing demand for green hydrogen while maximising product localisation through an enhanced local supply chain and automation for cost competitiveness.

Back in August 2023, it had announced that along with IOC and ReNew formed a company called GH4India Private. Each company has a 33.3% stake in GH4India.

Together, they will invest up to US$ 4 bn in their green hydrogen businesses over the next three to five years.

Apart from this, the company is working on setting up the world's largest green hydrogen plant being built by a Saudi-based green hydrogen company - NEOM Green.

Going forward, L&T plans to expand its focus on green hydrogen projects in global markets, aiming to strengthen its presence in the sustainable energy sector.

For more details about the company, check out L&T's fact sheet and quarterly results.

#5 Adani Enterprises

Next on the list is Adani Enterprises.

Building upon its success in power, oil & gas, infrastructure, and airports, Adani Enterprises is now poised to make significant inroads into the green hydrogen sector.

Adani Enterprises through its wholly owned subsidiary Adani New Industries has spent US$ 2.5 billion (bn) so far in developing a backward integrated value chain for its green hydrogen project

It's on track to implement the first phase of the project with an annual capacity of 1 m tons by FY27.

The aim is to increase the capacity to 3 m tons in the next ten years with an investment of US$ 50 bn.

The green hydrogen plant is coming up at Mundra in Gujarat.

The backward integration includes developing a fully integrated value chain across solar, wind, electrolysers, and allied equipment for the generation of green hydrogen and its associated sustainable derivatives.